Understanding the Role of a Trustee in California

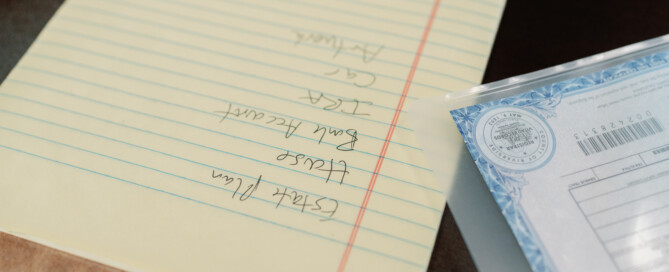

When creating a trust, one of the most important decisions you’ll make is choosing a trustee. The trustee is the person or institution responsible for managing the trust’s assets according to your instructions. It is a position of great responsibility, requiring honesty, organization, and good judgment.