When Should You Update Your Living Trust?

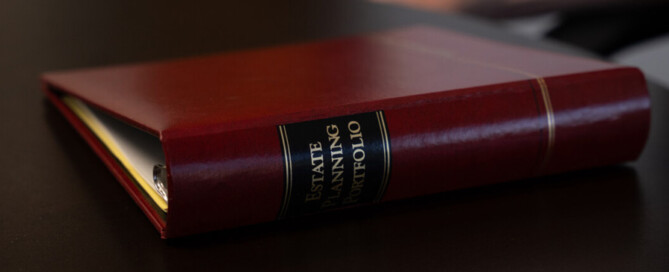

How often should a living trust be updated? I recommend you review your living trust every three to five years. This gives you the opportunity to look at it with fresh eyes. In my experience, when clients have a living trust prepared, the binder with the trust documents is set on a shelf and rarely looked at again.