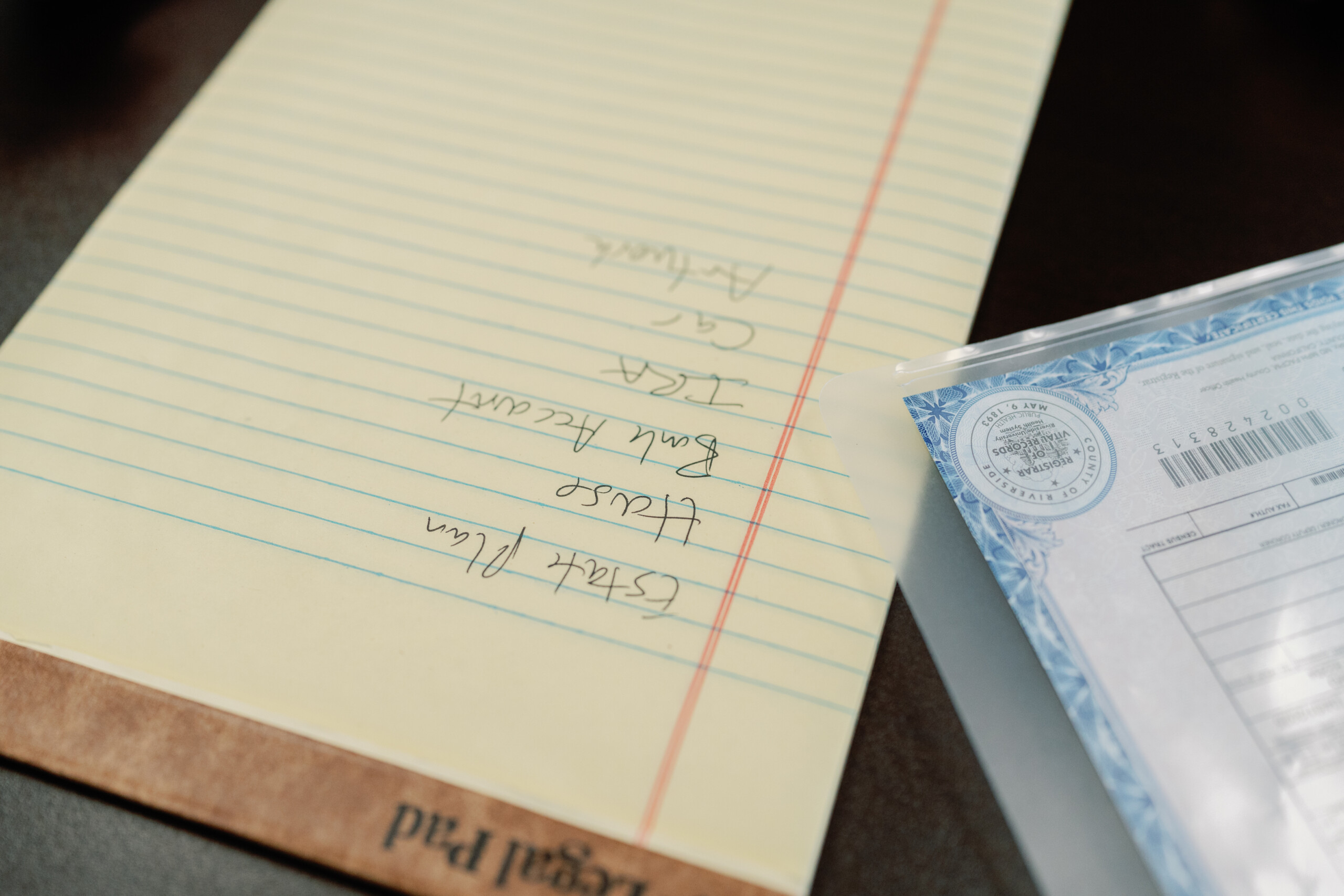

Second marriages can be a wonderful new chapter in life. They often bring renewed companionship, shared dreams, and a sense of stability. At the same time, they can also introduce more complexity into estate planning, especially when both spouses bring assets, children, or even businesses into the marriage.

Many couples in Palm Springs find themselves in this exact situation. Perhaps you own a home from your first marriage, while your spouse brings investment accounts or a business into the relationship. You may both have adult children and want to make sure they are provided for, while also ensuring your spouse is cared for. Without careful planning, conflicts can arise and assets may not pass in the way you truly intend.

Balancing Care for Your Spouse and Your Children

One of the most common concerns in a second marriage is how to balance providing for a surviving spouse while still protecting an inheritance for children from a prior relationship. If you rely solely on a basic will, your spouse may end up with control of all assets and your children could be unintentionally left out. A living trust is often a better tool, because it allows you to structure distributions in a way that provides financial support for your spouse during their lifetime, while preserving a share for your children afterward.

Protecting Separate Property

California is a community property state, which means that assets acquired during the marriage are generally shared. However, property or accounts you bring into the marriage are considered separate property. Keeping good records and ensuring that your estate plan distinguishes between separate and community property is essential. Otherwise, the lines can blur over time, creating confusion and disputes.

Business Ownership

For those who own a business, a second marriage requires an added layer of planning. Without proper documentation, ownership or control of the business could end up in the hands of someone who is not equipped to manage it. A buy-sell agreement or a trust tailored for business succession can help you ensure that your business is protected, and that your spouse and children benefit fairly from its value.

Beneficiary Designations

Retirement accounts, pensions, and life insurance policies pass directly to the named beneficiary, regardless of what your will or trust says. In second marriages, it is important to regularly review and update these designations. Failing to do so can unintentionally leave assets to a former spouse, which is a mistake I have seen more than once.

Communication and Clarity

Estate planning for second marriages is not only about documents and legal strategy. It is also about open communication. Talking with your spouse and, when appropriate, your adult children can help set clear expectations and reduce the chance of conflict later. An estate plan that is thoughtfully prepared and clearly explained is one of the best gifts you can leave behind.

Moving Forward with Confidence

A second marriage can bring both joy and complexity, but with the right estate plan in place, you can move forward with confidence. By addressing these issues directly, you protect your spouse, honor your responsibilities to your children, and preserve the assets you have worked hard to build.

If you have recently remarried or are considering it, now is the time to review your estate plan. Making sure it reflects your new life will help you avoid costly disputes and ensure peace of mind for you and your loved ones.